Seychelles Chamber of Commerce chairman Marco Francis refutes Sri Lankan fraud allegations

Marco denies involvement with Robert November 5, 2014 The story published in Lanka Herald about Sri Lankans being swindled in the Seychelles has resulted in one of the accused, Marco Francis writing to the website disowning himself from Robert Piksa’s actions. Francis in his response said, “Yes, I am a shareholder in a company with Mr Piksa and yes, we export fish to Sri Lanka, but all our activities are above board. Also whatever dealings Robert Piksa has or had done on his own I cannot be responsible. I have never indulged in nor will ever go into money laundering.” Following is the response sent by Marco Francis. I am writing to you in reply to the article in Lanka Herald on October 30, 2014 title “Sri Lankans swindled in the Seychelles”. In the article you specifically mentioned my name Marco L Francis have “swindled” a number of unidentified Sri-Lankan nationals seeking to do business in the Seychelles. Also “cheated many Sri Lankan businessmen promising dea...

Then you have Laporte,PP going around telling the world Seychelles economy is vibrant,on theright tracks,better than any African countries.

ReplyDeleteSeychelles prodcutivites have stagnated,TOo much l^money laudering,fiancial leakage and many foreign companies not paying thei dues.

Seychelles lives of Chrity,foreign aid,this addiction maeks PP unwilling to work hard to produce and depends of A Nation productivity.

TOo much corruption,over spending--PP spend more than it can produce and that each year and dtio to Budget surplus--Each Laporte ask for surplus of money to add to the Budget ,It seem Lpaort cannot evaluate our annual psending correctly that year after year and after the Budget is made public ,months latter Laporte ask for extra millions.

Exports --we literally do not export------TUNA are exported by foriegn Tuna Sieners making multi-billions annually

_Sea cucumber export by Chinese to China instead of our people rpocessing and importing

-Most five star hotel bank their money abroad etc..etc..etc

--With five star importing even products like Fish,vegetable,fruits that can find locallly ,help importation numbers and bad for our economy.

Dr Laporte should know as economist that when one country import more than it export--we have a TRADE DEFICIT and often Trade deficit is a cuase of STRUCTURAL eakness in the economy and not only an increase Dollar whatever INFLOWS.

High deficits and astronomic debt are conditions might derail economic growth.Morevoer,when a country's debt position is already precarious Like the case of Seychelles it could make it more vunerable to soveiregn default during a downturn of exteranl shocks.

High debts ususally induce governemnt to increase tax or cut spending--the first in aplicable but while when i comes to spending Pp continues to spend like a drunk sialors without ccounting and most of the time investemnt that governemnt cannot accounted for.

High >Governemnt slalry higher than some EUropan Countires with self-given Astronomic pension for life all these put a durben on our economy.Wastage,over charged or estimated governemnt projects most of the time Cost higher than what it should----a means for ministers and contractures to rob toegether tax payes money by over-charging governemnt projects cost etc...

Education,Health,Military,Social security all these are important instituions in a osicety but it is also costly--thus the way those instituions are fianace and sponsor is just not sustainable and go not work on the long terms--for their costs keep increASING FOR many REASONS AND IF NOT SPONSOR AND FIANCIAL BY OTHER MEANS WE ARE BOUND TO collapse.

And of course tax payers money use as party fianacing and expenses,to pay Foreign Ambassadors,and foreign offical to illegally contr0ol important instituions thus giving them a fortune three,four five times higher than Seychelles with same or even better qualification than foreigners--the only reason recruit foreigners is that Pp is sure foreigners for thier money and not in their country would do anything the rogue governemnt asks them which Seychellois might not do or hesitate to do.

Jeanne D'Arc

Now that IMF is not there, Seychelles has a relapse of the three symptoms for another financial collapse - high expenditure, low monetary reserve, and very high import.

ReplyDeleteCentral Bank is contemplating devaluation as a solution to soften the shock but too timid to do so after so much bravados lately how the Seychelles economical reform could be an example for neighboring countries. Come on Pierre, if you cannot come on SBC, send your cropped-hair assistant.

She is very able, as her name implies. Sic!

DeleteAfter taking care of their salaries first, Pp thinks that the measures of tightening fiscal monetary policy and rising interest rates are only good for IMF and publicity but devaluation would help reduce the country's deficit.

ReplyDeletePierre is the opposition in Seychelles?

ReplyDeleteNever heard about that?

Where is his office?

Who is his second in command?

Does his party got a new paper....errr leaflet?

How did he became opposition?

Pti Pierre.

Chinese controlling our sea cucumber seen years,you know how many million pp crooks have made seen in this business with chinese,soon chinese will control our fish.And its not happening only in Seychelles.Chinese invading Africa they want to control peanuts in Senegal.And Senegalese have said they will stop chinese controlling their peanuts by stoping selling it.Take example seychellios if you want to do somethings to save your country from a corrupt sytem.

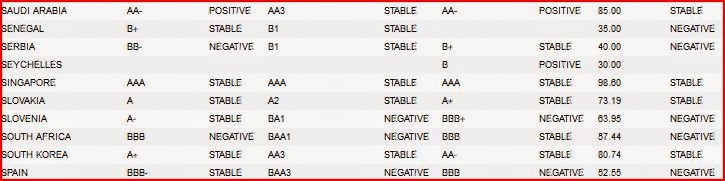

ReplyDeleteSeychelles B grade is relative---it is a reflection of fiscal and fiancial uncertainty that is hurting our economy.

ReplyDeleteI think Pp is talking about tighten fiscal monetary policy not to say Devaluation.The latter is most probable.

We had a few years a devaluation,we cannot solve the problem solely by devaluating our currencies.A devaluation will still hit corporate loans and bring with it "a wave od disssolvencies"and infaltion would even become more difficult to get under control.The relief will be short life.

It would have advert impact of lender countires.Imports will cost more that is price increase for population which is not good for consumption an import tool for boosting economic growth(Seychellois will become poorer)In other words a DEVALUATIONJ is a decline in the standard of lving.

Traditionally Devalaution is a tool used by a desperate government with poor economic policy

COmpetitiveness is usual restore by a decline is real wages.This can get achieved by having NOMINAL WAGES falls while the exchange rate is unchanged. or having wages fails to adjust the inflatory effects of devaluation.Either way we come to a standard of living decline.

A devaluation can be a good thing,with a little of inflation.more if would produce more than import than it would have made decrease price,etc... but our case is so that inflation is too high anda devaluation won't help as the privous devaluation.. In a word devaluation increases the amount somebody's else money can buy(foreign investors)not at domestic level and npt for those selling stuff domestically.

Jeanne D'Arc

Pti Pierre

ReplyDeleteInitially fiscal monetary policy and rising rates where changes in these polcies would affect OUtput.Under PP this is not for sure.In reality there is no real link between monetary policy and real variables.This change in monetary and fiscal policy cannot affect the total level of output becuase the total level of output is determined by the Factor of PRODUCTION and not by monetary viarables(called Neutrality of money).

Moreover.consumption tends to fall and the intrest rate rises,because the incentive for saving increases.Investment tedns to falls as the intrest rate rises,because the cost for borrowing money increase.Net export tends to rise,as intrest rate risie becuase domestic investment is relatively more attractive to both foriegn invesstors and locals.

Recall that the tools of fiscal policy is TAXES and Government spending,.When the governemnt increase governmnet spending,there should be an indirect increase in output,as mitigated by government spending multiplier.In reality,government spending does not change output as the government spending multiplier would seem to indicate.It does ,instead signficantly change the intrest rate.That is as intrest rate rise ,investment falls.That is because the intrest rate is the opportunity cost of holding money,and as this increase,taking out loan become less attractive.

When governemnt increase spending the intrest rate rises and investment falls(called crowding out).That is increase in governemnt spending tends to replace(or crowd out private investment)Thsi work becuase the total level of output is fixed by the factors of production,thus causing there,neccessarily to be an equal and opposite change in governemnt from an increase in governemnt purchase.Because investment is more sensitive to intrest rate than consumption or net exports,investment takes the primary hit from the fiscal policy change.For this reason,crowding out always occurs when expansionary fiscal policy is used.In the long run such policy may hammer economic growth since investment qffect the factors of production,which in turn do affect total output.

Should not ministers earning an astrnomic salary and life pension maybe start paying taxes.It is something we should look into for those working in public sectors and earning astrnomic and unjustified salary,bonuses,persk.life pension.

Make them contribute to society instead of just fulling their pckets and robbing Seyhellois.Not to forget EXAPTS like CEO of Air Seychelles etc... those persons earning high salary should be made to pay taxes not only benefti from us but contribute their shares,

SFP has long enveil their crooked tactic and that before even FAURE annouced it.SFP has once against proven PP members are thugs,State roganize criminals,and there is no differetn if they are Called FAR;MICHEL FAURE;MERITON etc they all members of PP becuase they share the same traits,beleif,ideology and wickedness.

AND SO ON.

Jeanne DArc

PP Blue Economy after four decades long irresponsibly allowing foreign FIshing fleets to rob us billions in revenues and not to mention themany illegal fishing ships from Thalain,Iran,Twaiwan,China,Sri Lnak etc robbing our resoureces wihle PP tells us its has modern technologies to observe thw whole of our EEZ.

ReplyDeleteOur Blue Economy --seem to belong to Khalifa too.Meetings of on Blue Economy which should be a National issue is not hold in Seychelles but in UAE.Seychellois forMichel is not the owner of our >Blue economy but Khalifa.

After literally destorying our Green economy,and folling Seychellois with blak gold ,PP think preaching about our Blue economy now would make Seychellois forget the 4 decades it has allow foreigners to rob their resources.PP after the coup D'etat told us ,we will build our own TUna seiner fleet,4 DECADES LATE sEYCHELLOIS are still awaiting for the ever first Tuna siener in victoria port.It is probably being constructed on MARS.

TOns of sea weeds infest our sohres during the north east monsson.World markets of seaweed is enorm.More than 30 plus products are derived from seaweeds:Tooth paste,comestics,baby food,medications,health cares -FERTILIZERSetc... YOu know what while Michel the maron preaches about Blue economy and its importance.At the same time PP pays task force to collect tons of seaweed and just throw them into bushes instead of using it effectively and beneficially,,ToNS OF fiSH ARE dISCARD EACH YEARS BY FOREIGN TUNA SIENERS INTO THE ocEAN,THAT IS MULTI-MILLIONS OF DOLLARS IN REVENUES POURED INTO THE SEA.

sEYCHELLES BLUE,GREEN,RED ,YELLOW WHATEVER COLOR OF ECONOMY is owed by Seychellois and they should decide what to do ,how to use it not Khalifa dog.

Jeanne D'Arc